The cryptocurrency market has been experiencing a significant surge in recent days, with XRP being one of the top performers. Following US President Donald Trump’s announcement of a $2,000 stimulus check for most Americans, the price of XRP rose by 12% to $2.53. However, despite this upward trend, there are concerns that increased profit-taking by long-term investors could slow down the recovery. In this article, we will delve into the current state of XRP and explore the potential hurdles that it may face in the coming weeks.

XRP Price Analysis

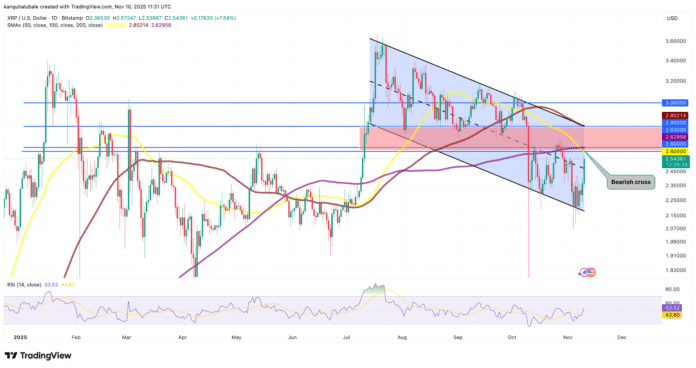

The price of XRP has been fluctuating within a descending parallel channel, with the 50-day simple moving average (SMA) and 100-day SMA converging at $2.60. This resistance level will pose a significant challenge for the bulls, who need to overcome it to reach the upper boundary of the descending channel at $2.80. A break above this barrier would increase the chances of a rally towards $3 and later to a seven-year high of $3.66. The XRP/USD daily chart below illustrates this trend.

According to Glassnode, the distribution heatmap shows a significant supply cluster centered around $2.80 (100-day SMA), where nearly 1.86 billion XRP have been acquired. This could hamper any recovery efforts, making it essential for bulls to overcome this resistance to climb to $3.

Profit Realization and Whale Activity

Long-term holders (LTHs) of XRP, who have held the cryptocurrency for more than 155 days, have increased their profit-taking. Glassnode found that the profit realization volume (7D-SMA) has risen by 240% since the end of September, from $65 million per day to $220 million per day. This surge in profit realization has coincided with a 25% decline in the price of XRP from $3.09 to $2.30.

Santiment’s “Supply Distribution” metric shows that whales holding between 1 and 10 million XRP tokens have offloaded an additional 500,000 tokens in the last 48 hours alone. These companies now hold about 6.23 billion XRP, down from about 7 billion at the beginning of September.

However, outflows from whale wallets have declined after the $650 million sale, indicating a possible bottom for XRP. This could drive the XRP price higher in the coming weeks, especially when combined with rising risk appetite triggered by the likely reopening of the US government this week.

Conclusion

In conclusion, while XRP has shown a significant surge in recent days, there are concerns that increased profit-taking by long-term investors could slow down the recovery. The cryptocurrency faces strong resistance at $2.60-$2.80, which will pose a formidable hurdle for the bulls. However, if XRP can overcome this resistance, it may be able to reach $3 and later to a seven-year high of $3.66. For more information on XRP and the cryptocurrency market, visit https://cointelegraph.com/news/xrp-profit-taking-signals-weakness-will-it-delay-recovery-3?utm_source=rss_feed&utm_medium=rss_category_market-analysis&utm_campaign=rss_partner_inbound.