XRP Enters Institutional On-Chain Spot Trading via Hyperliquid

Following the launch of FXRP on Hyperliquid spot markets, XRP has entered institutional on-chain spot trading. This is the first time that XRP exposure is available on Hyperliquid’s fully on-chain order book.

The listing, announced by Flare on January 7, introduces an FXRP/USDC trading pair and expands the way XRP can be traded, transacted and used in decentralized finance without relying on off-chain custody.

FXRP Listing Brings XRP to Hyperliquid Spot Markets

The listing makes XRP spot exposure available on Hyperliquid’s powerful trading infrastructure, an environment best known for its dominance in decentralized perpetuals. FXRP is a bridged representation of XRP issued via Flare’s FAssets system and delivered using LayerZero’s Omnichain Fungible Token standard.

This setup allows XRP to move from the XRP Ledger to Flare, move seamlessly across chains, trade with Hyperliquid, and return to the XRP Ledger as its canonical settlement layer. The structure preserves XRP custody while expanding its applicability to decentralized finance environments that the asset was previously inaccessible.  Source: ASXN

Source: ASXN

Hyperliquid’s Spot Markets and Trading Volumes

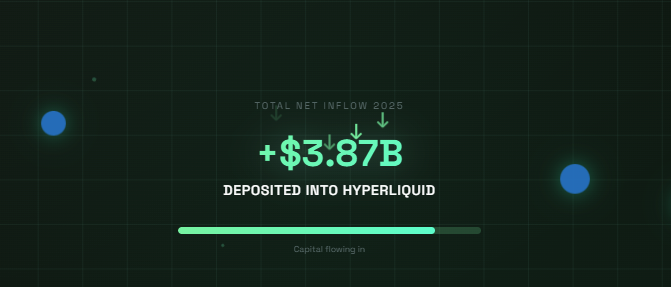

Hyperliquid’s spot markets differ from the automated market maker pools that dominate most decentralized exchanges. Its order book-based design is designed to handle higher trading volumes with improved price discovery and execution quality, especially during periods of volatility. The platform added more than 609,000 users during the year and recorded net inflows of $3.8 billion, showing increasing demand for decentralized derivatives from both retail and institutional traders.

FXRP Volume Jumps, Indicating Increasing Demand for On-Chain XRP Trading

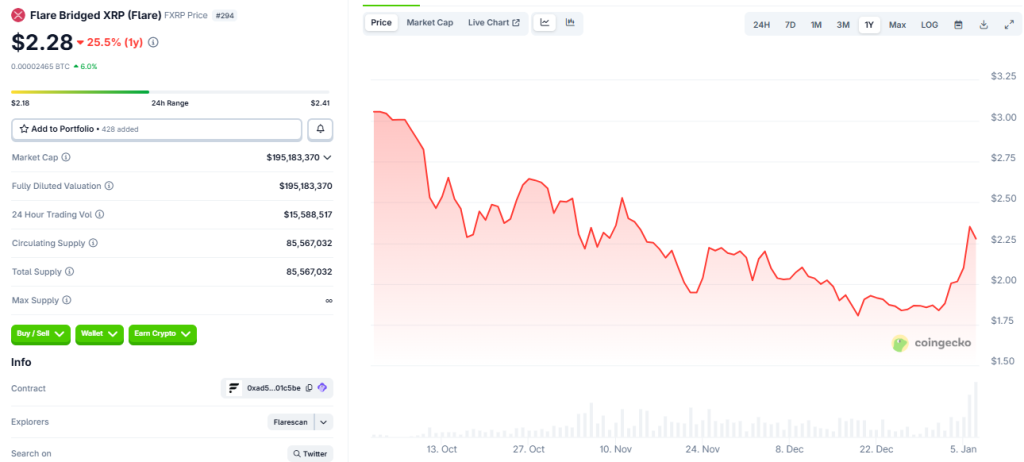

Market activity around FXRP has increased post-launch. Data from CoinGecko shows that the token is trading at around $2.29, with a circulating supply of approximately 86 million tokens and a market cap of nearly $197 million.  Source: CoinGecko

Source: CoinGecko

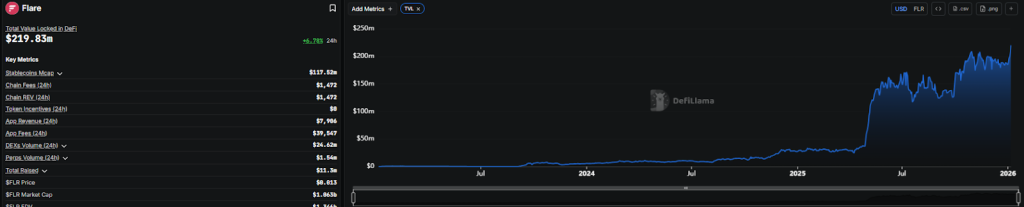

Over the past week, FXRP has surged more than 20% while 24-hour trading volume has increased to over $14 million, showing increasing participation as liquidity moves between trading venues. For Flare, the integration strengthens its broader XRP-focused DeFi strategy. The network currently holds nearly $220 million in total value, with decentralized exchange volumes surging over the past week.  Source: DeFiLlama

Source: DeFiLlama

Seven-day DEX trading volume on Flare exceeded $84 million, more than doubling week-over-week, while the stablecoin market cap on the network also increased. Once executed on Hyperliquid, FXRP can be transferred back to Flare to access lending, staking and other XRPFi applications, or returned to the XRP ledger via upcoming tools designed to simplify one-click withdrawals. This trading lifecycle allows users to bridge once, trade at scale, and rely on XRPL again without relinquishing custody at any point.

For more information, visit https://cryptonews.com/news/xrp-institutional-onchain-spot-trading-hyperliquid/