Yzi Labs Invests in USD.AI, a Stablecoin Protocol for AI Infrastructure Financing

Yzi Labs has made a strategic investment in USD.AI, a stablecoin protocol designed to provide infrastructure financing (infrafi) on-chain by granting hardware operators with hardware collateralization. This move highlights Yzi Labs’ growing commitment to supporting the basic infrastructure required to meet the massive capital needs of the artificial intelligence sector.

USD.AI, built by Permian Labs, is a synthetic dollar protocol that enables infrastructure providers and AI companies to access non-dilutive loans supported by physical arithmetic hardware. After the announcement, the investors, in turn, receive a sustainable return from asset-backed loans. The protocol has already secured the support of top-tier investors, including Framework, Libelle, Digital Currency Group, Delphi, and Fintech Collective.

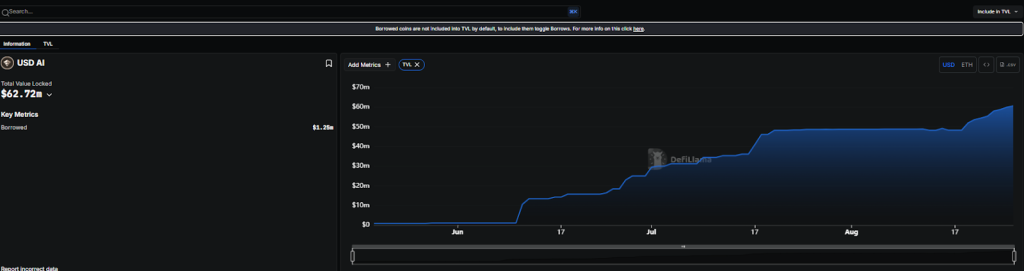

USD.AI Secures $62.7 Million TVL as a Stablecoin Protocol Targeting the AI Financing Gap

USD.AI has secured $62.7 million in Total Value Locked (TVL) since its launch, providing loans that are secured 1-1 with AI hardware. This approach allows for faster loan processing, with loans being made in less than a week, compared to the 60 to 90 days typical of traditional funding. For capital-intensive sectors, this speed can mean the difference between scaling and stagnation.

According to Defillama’s data, USD.AI’s deposits have grown steadily, rising from practically zero to over $62.7 million since June. The protocol’s adoption curve has been steep, with deposits increasing from $10 million in mid-June to $30-$40 million in July and accelerating again in August to reach its current all-time high.

Source: Defillama

Yzi Labs Emerges as a Force Behind Institutional Push into BTC and BNB Ecosystems

Yzi Labs, the renamed investment arm previously known as Binance Labs, has accelerated its push towards institutional adoption and ecosystem expansion. Since its relaunch in January, the company has expanded its scope to include artificial intelligence and biotechnology, while strengthening its commitment to blockchain.

Changpeng Zhao, the former CEO of Binance, has played an active role as a mentor for startups within the program, while co-founder Ella Zhang has returned to lead operations. In May, the company made a significant bet on the DeFi ecosystem around Bitcoin, investing in Avalon Labs, a BTC-based platform that has developed capital markets around BTC collateralized lending, stablecoin, and credit services.

For more information, visit https://cryptonews.com/news/yzi-labs-backs-usd-ai-stablecoin-yield-bearing-ai-backed-play-raises-big-questions/