Privacy Coins Surge 80%: Why Zcash and Dash Are Back in the Spotlight

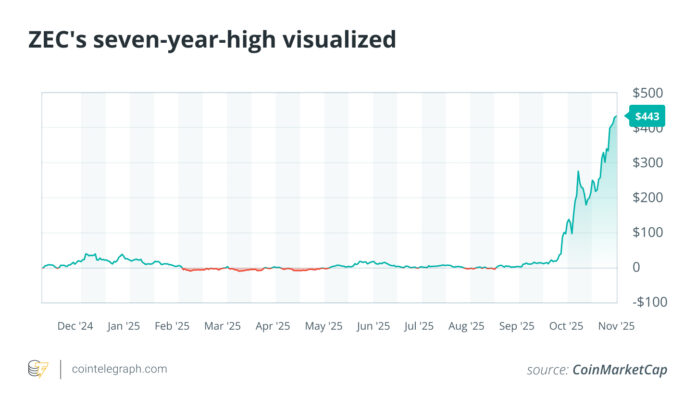

Privacy-focused cryptocurrencies have experienced a significant surge in value, with the sector’s combined market capitalization rising nearly 80% by November 2025. This increase has been driven by a combination of factors, including technical breakouts, derivatives positioning, and an upcoming Zcash halving. As a result, Zcash hit a seven-year high, while Dash reached a three-year high, as traders increasingly shifted their attention to privacy assets.

The move towards privacy coins reflects a growing demand for assets that offer stronger privacy features. With compliance-intensive on-ramps and blockchain analytics becoming more stringent, some traders are moving to assets that provide greater anonymity. The recent rally suggests that this narrative is gaining traction again, with Zcash and Dash being two of the main beneficiaries.

What Are Privacy Coins?

Privacy coins are cryptocurrencies designed to hide some or all of the details of a transaction, including the sender, recipient, or amount. They achieve this through advanced cryptography or mixing techniques that reduce linkability between addresses. This is in contrast to Bitcoin-style public ledgers, where every transaction is visible and analytics firms can often reconstruct user identities over time.

Zcash (ZEC)

Zcash supports two modes: transparent transfers (visible on-chain like Bitcoin) and protected transfers that keep transaction details secret. Its privacy features are based on zero-knowledge proofs, originally zk-SNARKs, which allow the network to verify transactions without revealing their contents. Since the Network Upgrade 5 (NU5) upgrade, Zcash’s Orchard Shielded Pool uses the Halo 2 verification system, a zero-knowledge protocol that eliminated the previous “Trusted Setup” ceremony and streamlined private payments.

Notably, Zcash rose to a seven-year high of nearly $449, posting triple-digit monthly gains as momentum gained. This surge has been driven by a combination of technical and fundamental factors, including the upcoming Zcash halving and increasing demand for privacy assets.

Dash (DASH)

Dash is designed for fast, affordable digital payments with optional privacy. Its wallet features CoinJoin, a non-custodial mixing mechanism that combines the inputs and outputs of multiple users, making individual transaction histories difficult to trace. CoinJoin works via masternodes and must be activated manually in the Dash core wallet. Standard transactions remain transparent by default, while users can choose how many rounds of shuffling to run, with additional rounds increasing plausible deniability but also slightly increasing processing time and network fees.

Why the Rally Now?

There are several factors driving the current rally in privacy coins. Firstly, there is a growing demand for assets that offer stronger privacy features, driven by increasing regulatory pressure and the need for anonymity. Secondly, technical breakouts and derivatives positioning have contributed to the surge, with ZEC breaking out of a multi-year downtrend and gaining momentum after clearing resistance. Finally, the upcoming Zcash halving has provided traders with a new catalyst, amid a largely stagnant broader market.

Risk, Access, and Compliance Considerations

Before investing in privacy coins, it is essential to consider several risk, access, and compliance factors. Firstly, regulatory pressure is increasing, with the Financial Action Task Force (FATF) pushing for full implementation of the travel rule, while the European Union’s new AML package tightens restrictions on “anonymity-enhancing” coins across all regulated platforms. Secondly, exchange availability varies by country and exchange, and is subject to change without notice. Finally, volatility and depth can be a concern, with order books thinning and slippage increasing, especially during off-hours.

To get exposure to privacy coins, investors can consider various options, including Grayscale’s Zcash Trust (ZCSH) in the US, or exchange listings and diversified Exchange Traded Products (ETP) shelves in parts of Europe. However, it is crucial to use data protection functions correctly, with Zcash’s privacy being optional and Dash’s CoinJoin needing to be activated and configured manually. If used incorrectly, metadata can be exposed, and the effectiveness of data protection compromised.

Conclusion

The 80% surge in privacy-focused assets reflects a mix of narrative, technology, and leverage. Zcash and Dash are not interchangeable, with one based on zero-knowledge proofs built into the protocol, and the other offering an opt-in mix alongside fast payments. However, both tend to benefit as the market shifts towards greater demand for privacy. When exploring this trading, it is essential to start with the mechanics, liquidity on your preferred trading venues, and the regulations in your jurisdiction, especially given the tightening of EU restrictions until 2027. Always assess your risk tolerance and seek professional financial or legal advice before making investment decisions in privacy-focused assets.

This article does not contain any investment advice or recommendations. Every investment and trading activity involves risks, and readers should conduct their own research when making their decision. For more information, visit https://cointelegraph.com/news/privacy-coins-surge-80-why-zcash-and-dash-are-back-in-the-spotlight?utm_source=rss_feed&utm_medium=rss_category_analysis&utm_campaign=rss_partner_inbound