Bitcoin (BTC) has been collecting some momentum within the crypto sphere in recent years, crossing the $60,000 mark towards a couple of analysts’ indicators. The sector’s chief cryptocurrency has been on a wild trip, with its worth fluctuations going haywire all through the era few weeks.

Bullish Elements Using Bitcoin Worth

One main driving force at the back of the hot worth surge in Bitcoin is the working out that a place Bitcoin ETF might be licensed via the SEC. With massive chance of this kind of choice from the SEC, which is prone to in any case unmistakable the door for higher institutional investments within the cryptocurrency, many traders are risking an front on the flow ranges.

Every other issue that has been riding Bitcoin’s worth has been the relief in untouched BTC provide following the halving tournament in the second one part of 2024. Typically, costs for Bitcoin have soared nearest halving via multiples, for the reason that lowered provide at once correlates with upper call for and value.

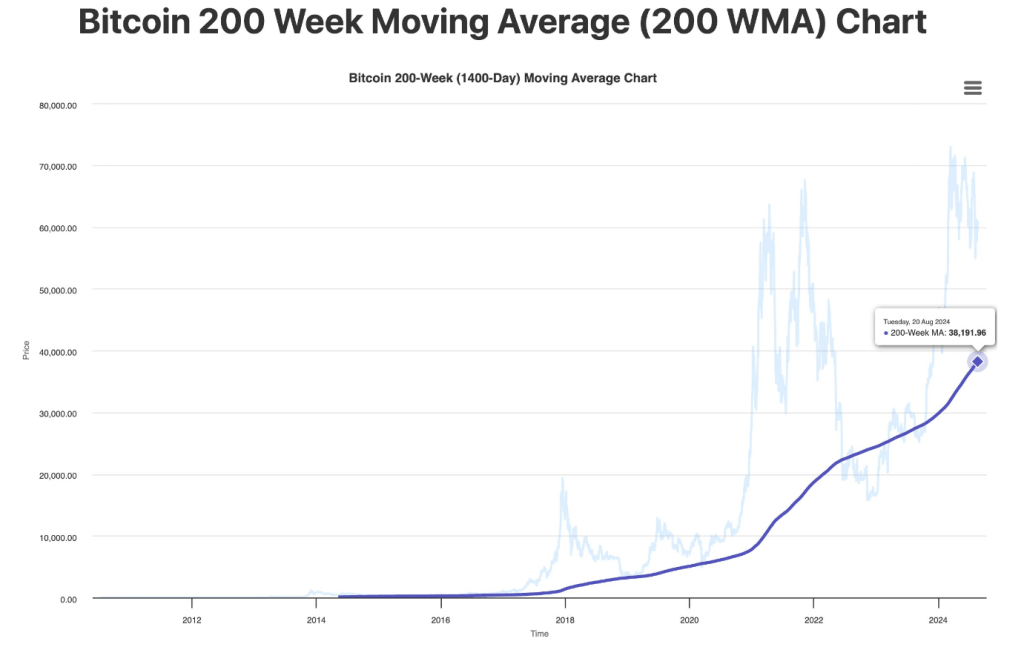

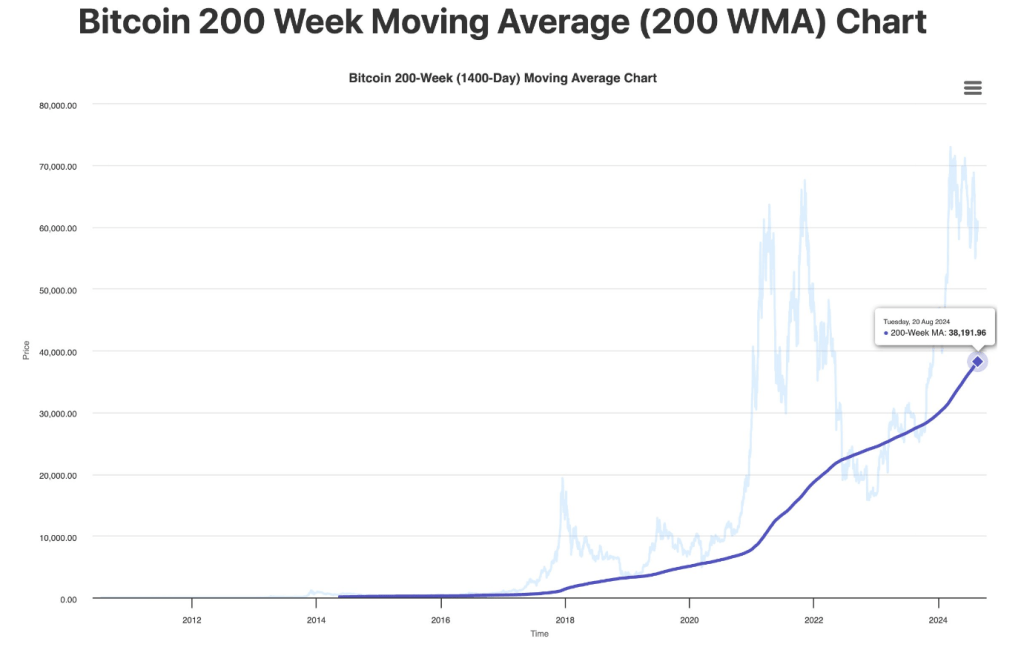

#bitcoin 200wma over $38k pic.twitter.com/olAw6BOjgz

— Adam Again (@adam3us) August 21, 2024

Bitcoin’s 200-Presen Shifting Moderate Supplies Robust Assistance

Blockstream CEO Adam Again defined that the 200-week shifting moderate of Bitcoin had risen era $38,000, a degree that now supplies cast backup for the cryptocurrency. Certainly, the 200MA has again and again been handled as probably the most noteceable signs in Bitcoin research for the reason that cryptocurrency by no means went underneath this shifting moderate.

Every other revealing metric so far as untouched Bitcoin good points are involved will be the conserving patterns of the asset. In step with knowledge revealed via the web web page BTCDirect, 69% of BTC supplying has now not moved for a future and even longer. In fact, every other example of a lessening quantity of BTC in flow is helping to relieve promoting power at the asset additional, cementing a bullish thesis for Bitcoin.

Bearish Elements To Believe

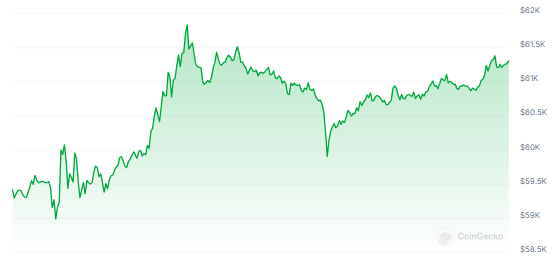

On the past of writing, Bitcoin was once buying and selling at $61,245, up 3.0% within the ultimate 24 hours, and sustained a 4.7% achieve within the ultimate seven days, information from Coingecko displays.

Regardless of the hot worth spike in Bitcoin, there are some bearish elements that stay within the background, considered one of which is the Mt. Gox repayments which might be prone to put extra promoting power into the marketplace. Previous within the moment, the notorious alternate made every other whopping switch to Bitstamp, surroundings off conceivable promoting power.

Alternative undergo elements are a rarity of willingly obvious bull catalysts similar time period for Bitcoin, with refer to being the actual from banking behemoth JPMorgan, advising purchasers to be very aware prior to purchasing into Bitcoin’s contemporary worth fix, because the cryptocurrency is prone to face headwinds into the after a number of months.

Featured symbol from Pexels, chart from TradingView