Bitcoin (BTC) has skilled a noteceable 15.7% value surge within the first six days of December. This surge has been closely influenced by way of the prospect of an forthcoming benevolence of a place exchange-traded treasure (ETF) in america. Senior Bloomberg ETF analysts have expressed a 90% chance for benevolence by way of the U.S. Securities and Change Fee, which is anticipated sooner than Jan. 10.

On the other hand, Bitcoin’s contemporary value surge is probably not as easy as it kind of feels. Analysts have didn’t imagine the a couple of rejections at $37,500 and $38,500 all the way through the second one part of November. Those rejections have left skilled buyers, together with marketplace makers, wondering the marketplace’s energy, specifically from the standpoint of derivatives metrics.

Bitcoin’s inherent volatility explains professional buyers’ lowered urge for food

Bitcoin’s 7.6% rally to $37,965 on Nov. 15 led to unhappiness because the motion absolutely retracted please see month. In a similar way, between Nov. 20 and Nov. 21, Bitcoin’s value declined by way of 5.3% upcoming the $37,500 resistance proved extra bold than expected.

Future corrections are herbal even all the way through bullish markets, they provide an explanation for why whales and marketplace makers are keeping off leveraged lengthy positions in those risky situations. Strangely, in spite of sure day by day candles all over this era, patrons the usage of lengthy leverage had been forcefully liquidated, with losses totaling a staggering $390 million within the pace 5 days.

Despite the fact that the Bitcoin futures top class at the Chicago Mercantile Change (CME) reached its perfect degree in two years, indicating over the top call for for lengthy positions, this development doesn’t essentially practice to all exchanges and shopper profiles. In some instances, supremacy buyers have lowered their long-to-short leverage ratio to the bottom ranges perceivable in 30 days. This means a profit-taking motion and lowered call for for bullish bets above $40,000.

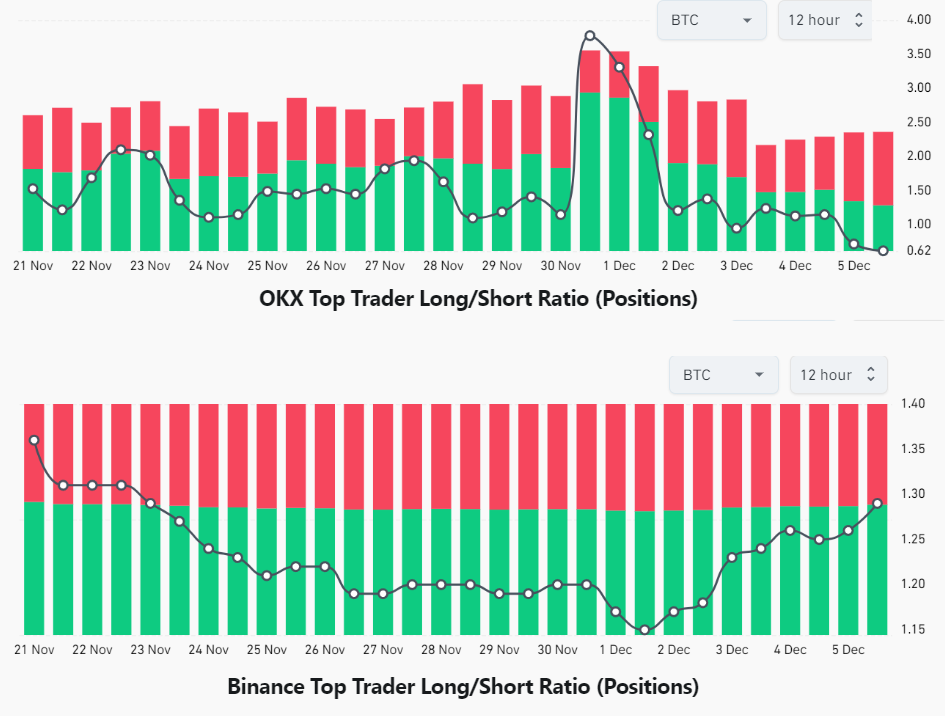

By means of consolidating positions throughout perpetual and quarterly futures oaths, a clearer perception can also be received into whether or not skilled buyers are leaning towards a bullish or bearish stance.

Settingup on Dec. 1, OKX’s supremacy buyers appreciated lengthy positions with a powerful 3.8 ratio. On the other hand, as the associated fee surged above $40,000, the ones lengthy positions had been closed. These days, the ratio closely favors shorts by way of 38%, marking the bottom degree in over 30 days. This shift means that some vital gamers have stepped again from the wave rally.

On the other hand, all of the marketplace doesn’t proportion this sentiment. Binance’s supremacy buyers have proven an opposing motion. On Dec. 1, their ratio appreciated longs by way of 16%, which has since greater to a 29% place skewed in opposition to the bullish facet. However, the being lacking leveraged longs amongst supremacy buyers is a good signal, confirming that the rally has essentially been pushed by way of spot marketplace batch.

Alike: Canadian crypto exchanges succeed in $1B in belongings underneath control

Choices information confirms that some whales aren’t purchasing into the rally

To resolve whether or not buyers had been stuck off-guard and recently secure brief positions underwater, analysts will have to read about the stability between shout (purchase) and put (promote) choices. A rising call for for put choices most often signifies buyers that specialize in neutral-to-bearish value methods.

Information from Bitcoin choices at OKX unearths an expanding call for for places relative to shouts. This means that those whales and marketplace makers would possibly now not have expected the associated fee rally. Nonetheless, buyers weren’t making a bet on a worth lessen because the indicator appreciated the decision choices on the subject of quantity. An abundance call for for put (promote) choices would have moved the metric above 1.0.

Bitcoin’s rally towards $44,000 seems wholesome, as refuse over the top leverage has been deployed. On the other hand, some vital gamers had been taken by way of awe, decreasing their leverage longs and appearing greater call for for put choices concurrently.

As Bitcoin’s value extra above $42,000 in prospect of a possible spot ETF benevolence in early January, the incentives for bulls to drive the ones whales who selected now not to take part within the contemporary rally develop more potent.

This text is for basic knowledge functions and isn’t meant to be and will have to now not be taken as criminal or funding recommendation. The perspectives, ideas, and reviews expressed listed below are the writer’s abandoned and don’t essentially mirror or constitute the perspectives and reviews of Cointelegraph.