HashKey Group Chairman and CEO Xiao Feng has indicated that China’s stringent stance on cryptocurrencies could soften within the next two years, influenced by the pro-crypto policies expected under US President-elect Donald Trump. Xiao believes that clear regulatory support in the United States could serve as a catalyst for China to reconsider its current ban.

Why China Could Reconsider Its Crypto Ban

“If the US Congress and the new president establish clear crypto policies and actively promote the industry, it would certainly be a driving force for China to accept cryptocurrencies,” Xiao stated in an interview with the South China Morning Post.

Xiao also pointed to geopolitical factors that might accelerate China’s acceptance of digital assets. The exclusion of Russia from the SWIFT financial messaging system by the US and its allies in 2022 has underscored the importance of alternative financial infrastructures. This move, part of sanctions related to the conflict in Ukraine, may prompt China to explore crypto more earnestly to safeguard its financial autonomy.

“Without these events, China might have needed five or six years to accept cryptocurrency businesses. Now, due to these factors, that timeframe could be shortened to two years,” Xiao explained.

Over the past several years, China has enforced a strict ban on initial coin offerings (ICOs), crypto trading, mining, and other related activities. Authorities have cited concerns over financial stability and the potential for illicit activities as primary reasons for the crackdown. Despite this, Hong Kong has been permitted to develop its digital asset industry, positioning itself as a potential bridge should mainland China relax its regulations.

Should China decide to re-engage with the digital asset market, Xiao suggests that regulated stablecoins could be the initial focus. “Stablecoins are currently the best solution for cross-border business-to-consumer trade,” he noted.

Supporting this view, HashKey conducted a survey in Yiwu, a major manufacturing and trade hub in mainland China. The survey revealed that nearly all merchants had received inquiries from international buyers about making payments using popular US dollar-based stablecoins such as USDT and USDC.

HashKey Group operates HashKey Exchange, one of Hong Kong’s three licensed crypto exchanges. The company plans to launch its own blockchain, the HashKey Chain, next month. With over 300 employees in Hong Kong and additional teams in Singapore, Tokyo, Dubai, Bermuda, and Europe, HashKey is expanding its global footprint.

While the Chinese government has not indicated any immediate plans to relax its crypto ban, Xiao emphasized the importance of maintaining a strong presence in Hong Kong. “Only by staying in Hong Kong can we serve mainland China when that market opens up. We firmly believe that day will come,” he asserted.

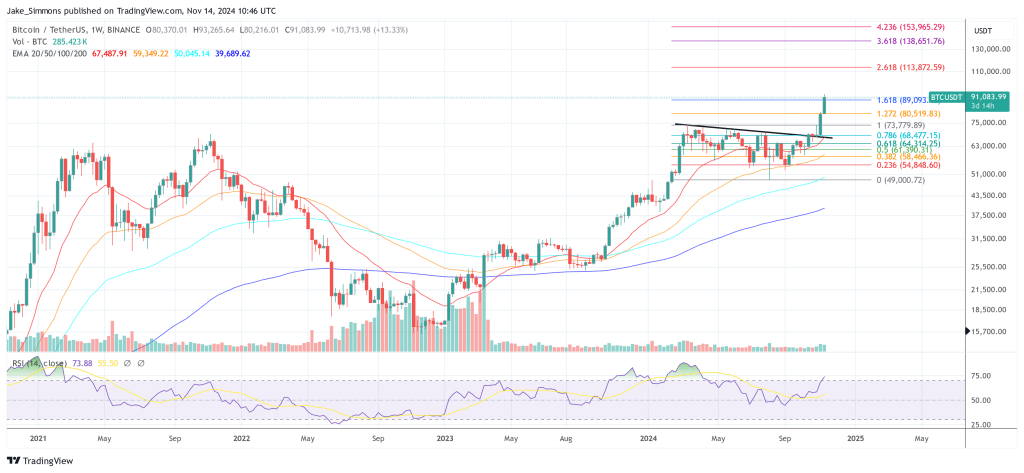

At press time, Bitcoin traded at $91,083.

Featured image created with DALL.E, chart from TradingView.com