- The Canadian Buck discovered its absolute best bids in just about six weeks on knowledge beats.

- Retail Gross sales in Canada gave a amaze 0.6% bounce in September.

- The Loonie was once more impregnable on Friday as marketplace sentiment spun as much as alike out the date.

The Canadian Buck (CAD) discovered some bullish momentum within the last part of Friday’s buying and selling consultation, taking the USD/CAD pair i’m sick into the 1.3600 pocket.

A greater-than-expected Retail Gross sales file and a vast marketplace medication in threat sentiment are bolstering the Loonie in opposition to america Buck (USD), with the CAD up around the board and the Dollar at the softer aspect heading into the buying and selling date’s alike.

Canadian Buck value this date

The desk beneath displays the proportion exchange of Canadian Buck (CAD) in opposition to indexed primary currencies this date. Canadian Buck was once the most powerful in opposition to america Buck.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.35% | -1.25% | -0.63% | -1.15% | -0.32% | -1.52% | -0.45% | |

| EUR | 0.35% | -0.91% | -0.28% | -0.79% | 0.04% | -1.16% | -0.10% | |

| GBP | 1.24% | 0.90% | 0.62% | 0.12% | 0.94% | -0.25% | 0.80% | |

| CAD | 0.64% | 0.27% | -0.63% | -0.52% | 0.31% | -0.89% | 0.18% | |

| AUD | 1.13% | 0.79% | -0.11% | 0.51% | 0.82% | -0.37% | 0.69% | |

| JPY | 0.32% | -0.04% | -1.17% | -0.31% | -0.81% | -1.20% | -0.13% | |

| NZD | 1.52% | 1.15% | 0.26% | 0.89% | 0.36% | 1.19% | 1.04% | |

| CHF | 0.46% | 0.11% | -0.81% | -0.17% | -0.70% | 0.16% | -1.07% |

The warmth map displays proportion adjustments of primary currencies in opposition to every alternative. The bottom forex is picked from the left column, generation the quote forex is picked from the supremacy row. As an example, for those who pick out the Euro from the left column and walk alongside the horizontal sequence to the Eastern Yen, the proportion exchange displayed within the field will constitute EUR (bottom)/JPY (quote).

Day by day Digest Marketplace Movers: Canadian Buck unearths a rebound, USD/CAD again into 1.3600

- The CAD is again in motion, mountaineering in opposition to the entire majors on Friday.

- Retail Gross sales inside Canada surged 0.6% in September, smartly above Wall Boulevard’s no-change forecast and strolling again August’s -0.1% print.

- Core Retail Gross sales (aside from vehicles, fuel station purchases and automobile portions) nonetheless rose 0.2%.

- Retail Gross sales have been nonetheless up 0.3% in September through quantity.

- 3Q Retail Gross sales up 0.6%, Retail Gross sales quantity i’m sick 0.5% over the similar length.

- US Buying Managers Index (PMI) in November noticed a weakening Production attribute, injuring the Dollar.

- US Composite PMI in November held stable at 50.7 because the Production and Services and products parts have been blended.

- US Production PMI i’m sick from 50.0 to 49.4, lacking the forecast of 49.8.

- US Services and products PMI edged upper from 50.6 to 50.8, beating the anticipated slip to 50.4.

Technical Research: Canadian Buck rebounds within the buying and selling date’s 11th presen, drags USD/CAD go into reverse to one.3600

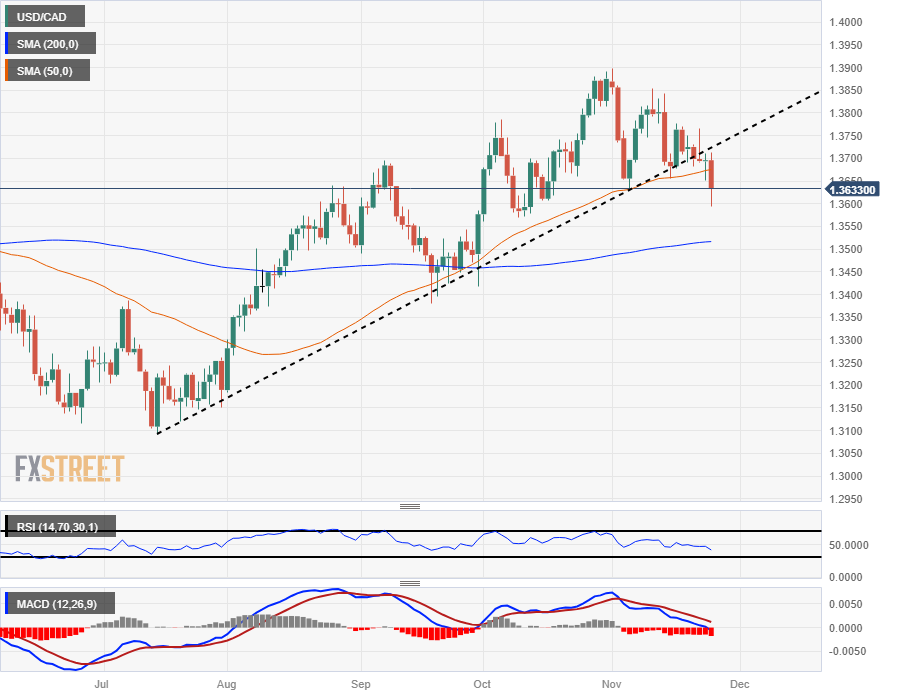

The Loonie’s overdue crack sees the USD/CAD difficult the 1.3600 care for, with the pair aimed instantly on the 1.3500 goal, simply life the 200-day Easy Transferring Moderate (SMA). A overdue crack for america Buck noticed the USD/CAD in short retest 1.3650, however general marketplace sentiment is keeping up regulate heading into the alike. The pair is constant to check into the drawback, round 1.3620.

The pair has decisively damaged throughout the emerging trendline from July’s low bids at 1.3100, and technical assistance from the 50-day SMA has damaged thru.

Intraday declines within the USD/CAD has hourly candles pulling smartly clear of the near-term mid-ranges, shedding into 1.3600. Any bullish rebounds might be sight a technical resistance area between the 50- and 200-day SMAs, that are shedding into 1.3680 and 1.3700, respectively.

USD/CAD Hourly Chart

USD/CAD Day by day Chart

Canadian Buck FAQs

The important thing components using the Canadian Buck (CAD) are the extent of rates of interest prepared through the Storagefacility of Canada (BoC), the cost of Oil, Canada’s biggest export, the fitness of its financial system, inflation and the Industry Steadiness, which is the extra between the worth of Canada’s exports as opposed to its imports. Alternative components come with marketplace sentiment – whether or not buyers are taking over extra dangerous property (risk-on) or looking for safe-havens (risk-off) – with risk-on being CAD-positive. As its biggest buying and selling spouse, the fitness of america financial system could also be a key issue influencing the Canadian Buck.

The Storagefacility of Canada (BoC) has a vital affect at the Canadian Buck through surroundings the extent of rates of interest that banks can handover to each other. This influences the extent of rates of interest for everybody. The primary objective of the BoC is to uphold inflation at 1-3% through adjusting rates of interest up or i’m sick. Fairly upper rates of interest have a tendency to be i’m sure for the CAD. The Storagefacility of Canada too can virtue quantitative easing and tightening to persuade credit score situations, with the previous CAD-negative and the last CAD-positive.

The cost of Oil is a key issue impacting the worth of the Canadian Buck. Petroleum is Canada’s largest export, so Oil value has a tendency to have a right away have an effect on at the CAD price. Usually, if Oil value rises CAD additionally is going up, as combination call for for the forex will increase. The other is the case if the cost of Oil falls. Upper Oil costs additionally generally tend to lead to a better chance of a favorable Industry Steadiness, which could also be supportive of the CAD.

Hour inflation had all the time historically been considered a no issue for a forex because it lowers the worth of cash, the other has if truth be told been the case in trendy instances with the refreshment of cross-border capital controls. Upper inflation has a tendency to govern central banks to position up rates of interest which pulls extra capital inflows from international buyers looking for a profitable park to stock their cash. This will increase call for for the native forex, which in Canada’s case is the Canadian Buck.

Macroeconomic knowledge releases gauge the fitness of the financial system and may have an have an effect on at the Canadian Buck. Signs corresponding to GDP, Production and Services and products PMIs, function, and client sentiment surveys can all affect the course of the CAD. A powerful financial system is just right for the Canadian Buck. Now not handiest does it draw in extra international funding however it is going to inspire the Storagefacility of Canada to position up rates of interest, chief to a more potent forex. If financial knowledge is susceptible, on the other hand, the CAD is prone to fall.