FOMC DECISION – MARCH MEETING

- The Federal Stock leaves rates of interest unchanged on the finish of its March assembly, in order with expectancies

- The 2024 coverage outlook extra the similar, with the Fed nonetheless signaling 75 foundation issues of easing for the moment

- Gold costs head upper because the U.S. greenback and turnovers remove a flip to the disadvantage

Maximum Learn: UK Inflation Falls to a Two-While Low, GBP/USD Strong for Now

The Federal Stock on Wednesday left its benchmark rate of interest unchanged at its wave area of five.25% to five.50% upcoming concluding its March coverage accumulating, conserving borrowing prices on store for the 5th consecutive assembly, in order with consensus estimates. As well as, policymakers made incorrect changes to their ongoing quantitative tightening program, simply as anticipated.

That specialize in the observation, the Fed maintained an upbeat view of the economic system, noting that macroeconomic signs recommend job has been increasing at a forged age and that the unemployment price extra low. Turning to shopper costs, the central locker reiterated that inflation has eased over the year moment, however persists at increased ranges.

With regards to ahead steering, the FOMC restated that it does no longer be expecting it’ll be suitable to take away coverage forbid till it has won higher self belief that inflation is converging sustainably towards the two.0% goal. This message, echoing January’s conversation, suggests officers are looking for extra sympathy on disinflation ahead of pivoting to a looser stance.

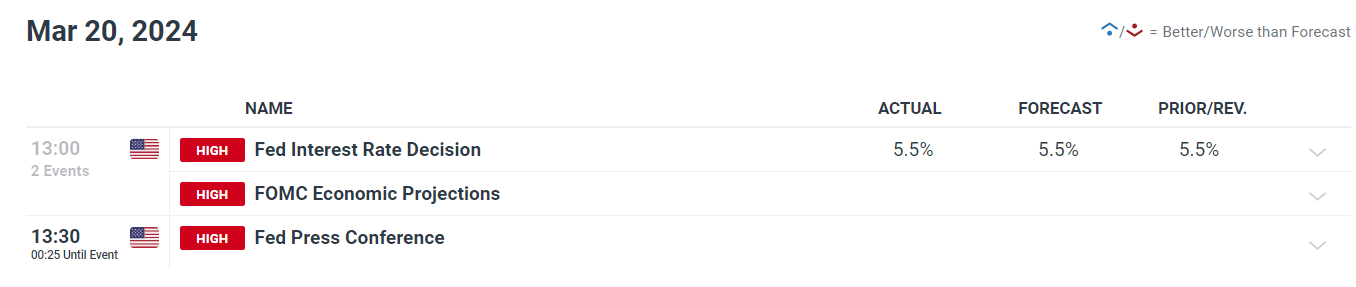

Supply: DailyFX Financial Calendar

Questioning in regards to the U.S. greenback’s potentialities? Achieve readability with our untouched forecast. Obtain a separate book now!

Beneficial via Diego Colman

Get Your Independent USD Forecast

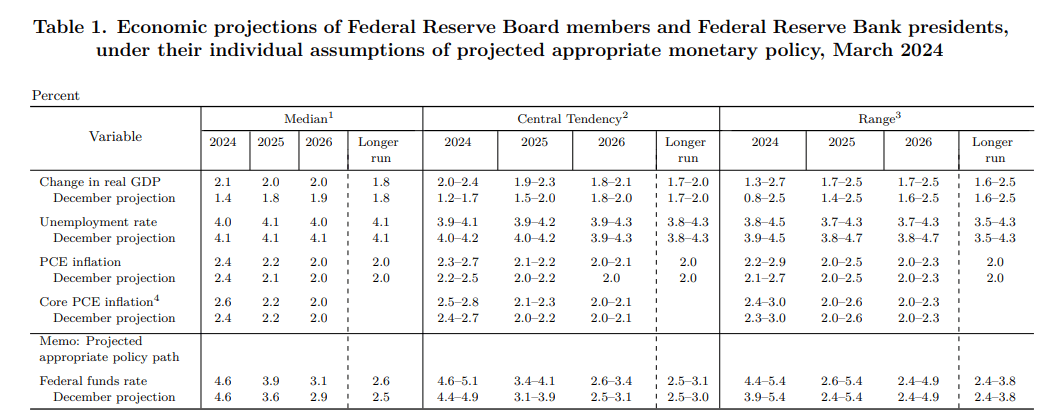

FED SUMMARY OF ECONOMIC PROJECTIONS

GDP, UNEMPLOYMENT RATE AND CORE PCE

The March Abstract of Financial Projections detectable noteceable revisions in comparison to the quarterly estimates submitted in December of endmost moment.

First off, GDP enlargement projections for 2024 had been upgraded to two.1% from 1.4% prior to now, pointing to higher self belief within the economic system’s resilience and its capability to influence sunlit of a recession.

Turning to the exertions marketplace, the outlook for the unemployment price for this marked all the way down to 4.0% from 4.1%, suggesting the Fed doesn’t watch for popular layoffs over the medium word.

At the inflation entrance, the Fed revised upwards its 2024 forecast for the core PCE deflator to two.6% from the former 2.4%, an indication that value pressures are anticipated to stay sticky for a longer duration.

FED DOT PLOT

The dot plot, outlining Federal Stock officers’ expectancies for the trajectory of rates of interest over a number of years and the long term skilled important adjustments in comparison to the former model introduced 3 months in the past.

Again in December, the Fed projected borrowing prices to finish 2024 at 4.6%, suggesting 3 quarter-point price cuts for a complete easing of 75 foundation issues. As of late’s iteration displays the similar outlook, indicating policymakers is probably not overly anxious about toning inflationary pressures simply but.

Having a look forward to 2025, officers see charges falling to three.9%, quite above the prior to now forecasted 3.6%.

As well as, the central locker raised its projection for the long-run federal finances price from 2.5% to two.6%, in all probability reflecting structural shifts in productiveness or enduring value pressures. This adjustment is quite hawkish, however markets seem extra involved in regards to the near-term outlook for now.

Please see desk supplies a abstract of the Federal Stock’s up to date macroeconomic projections.

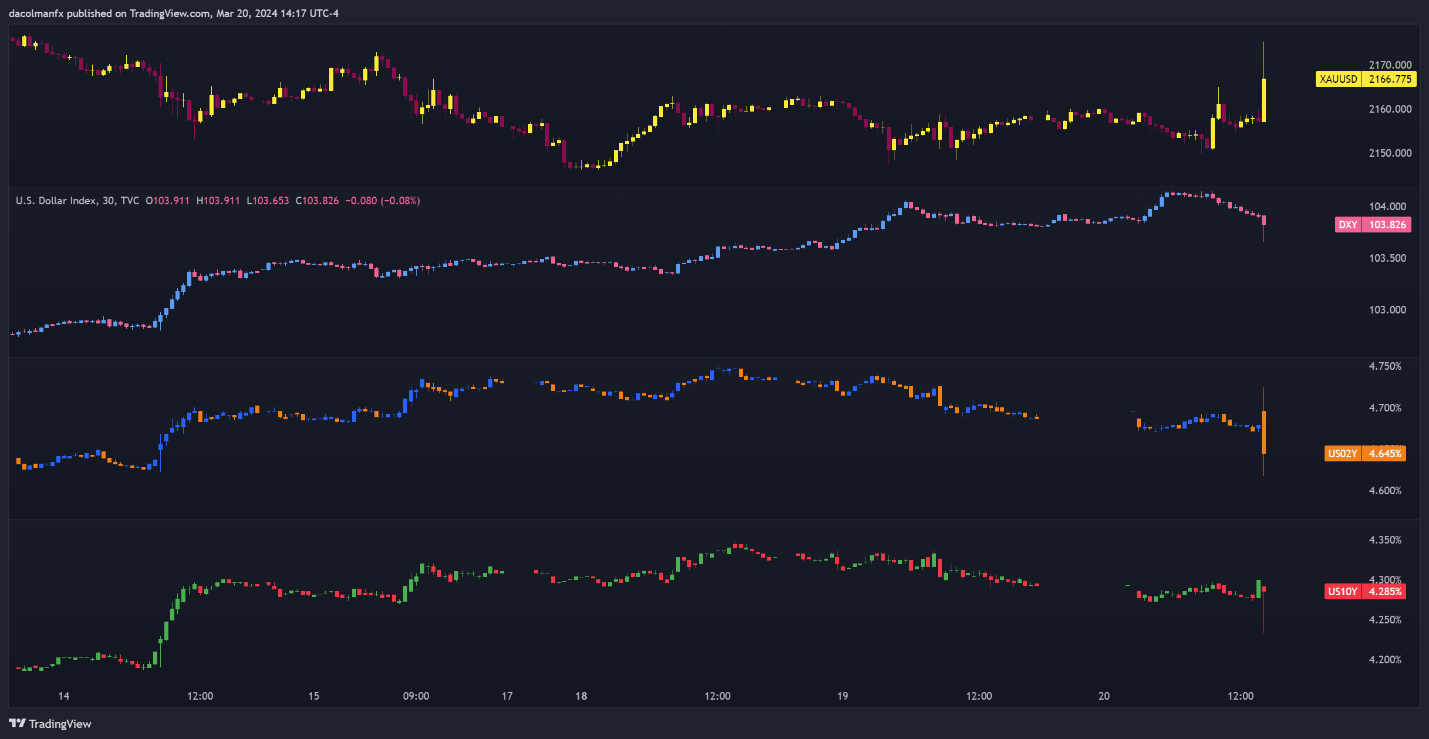

MARKET REACTION AND IMPLICATIONS

In a while upcoming the Fed’s resolution used to be introduced, gold costs driven upper, propelled via the pullback within the U.S. greenback and turnovers. The indication that the Fed remains to be intent on handing over 3 quarter-point price cuts this moment is having a bearish impact at the dollar on the hour of writing. For a clearer figuring out of the Fed’s financial coverage outlook, on the other hand, buyers must attentively track Chairman Powell’s press convention. In spite of everything, as of late’s response may just nonetheless opposite given the upside revision to the long-term equilibrium price.

US DOLLAR, YIELDS AND GOLD PRICES CHART

Supply: TradingView