UPCOMING EVENTS:

- Monday: UK/US

Vacations, German IFO. - Tuesday:

Australia Retail Gross sales, Canada PPI, US Shopper Self belief. - Wednesday:

Australia Per thirty days CPI, Fed Beige Reserve. - Thursday:

Switzerland GDP, Eurozone Unemployment Fee, US GDP 2nd

Estimate, US Jobless Claims. - Friday: Tokyo

CPI, Japan Retail Gross sales and Business Manufacturing, China PMIs, Switzerland

Retail Gross sales, Switzerland Production PMI, Eurozone Flash CPI, Canada

GDP, US PCE.

Tuesday

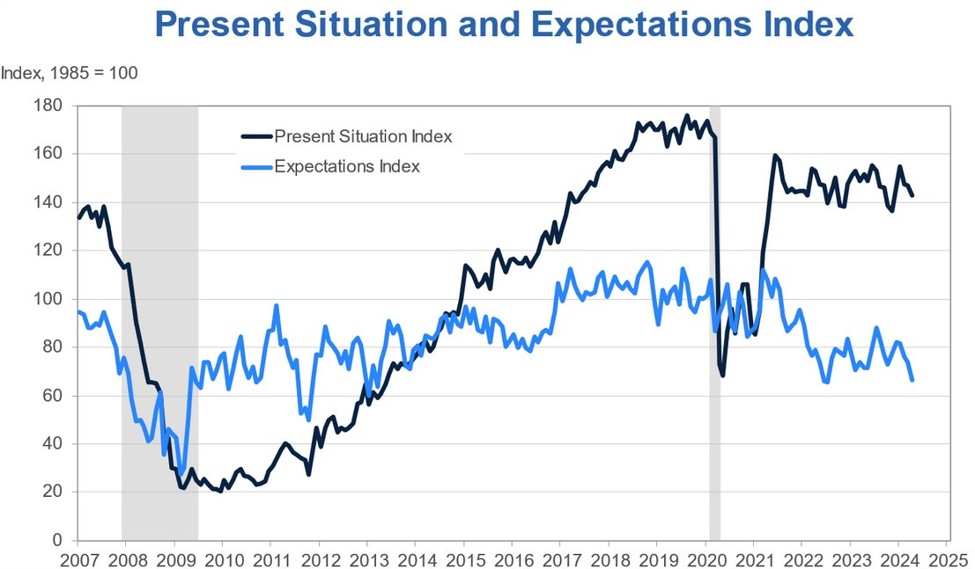

The United States Shopper Self belief is anticipated to

tick decrease in Would possibly to 95.9 vs. 97.0 in April. The ultimate

record neglected expectancies through a obese margin

attaining the bottom degree since July 2022. The Eminent Economists at The

Convention Board highlighted that “Self belief retreated additional in April as

customers turned into much less sure in regards to the stream labour marketplace status, and extra

taken with week trade situations, activity availability, and source of revenue”.

She additional added that “in spite of April’s

dip within the general index, since mid-2022, optimism in regards to the provide

status continues to greater than offset considerations in regards to the week.” The

Provide Condition Index can be one thing to look at as that’s normally a prominent indicator

for the unemployment price.

US Shopper Self belief

Wednesday

The Australian Per thirty days CPI Y/Y is anticipated

at 3.4% vs. 3.5% prior.

The RBA focuses extra at the quarterly CPI readings, however the per thirty days

indicator is timelier and generally is a information for the craze, particularly at

turning issues. The Core measures can be extra remarkable however this record is

not likely to modify a lot for the central attic on the hour, despite the fact that some other

sizzling record is more likely to cause a hawkish response out there.

Australia Per thirty days CPI YoY

Thursday

The Eurozone Unemployment Fee is anticipated

to stay unchanged at 6.5% vs. 6.5% prior. The velocity has been soaring on the

report low for a 12 months denoting a good labour marketplace. Additionally, the new Eurozone

Negotiated Salary Enlargement for Q1 2024 got here in

upper than the prior quarter, which used to be more or less a setback for the ECB even

despite the fact that they “dismissed” it as a one-off as a result of the behind schedule motion to lift

wages towards inflation in Germany. However, it’s going to give them much less

self assurance in regards to the price cuts trail following the only in June.

Eurozone Unemployment Fee

The United States Jobless Claims

proceed to be one of the crucial remarkable releases to observe each and every while because it’s

a timelier indicator at the circumstance of the labour marketplace. It is because

disinflation to the Fed’s goal is much more likely with a weakening labour marketplace.

A resilient

labour marketplace despite the fact that may assemble the fulfillment of the objective harder.

Preliminary Claims store on

soaring round cycle lows, year Proceeding Claims stay company across the

1800K degree. This

while Preliminary Claims are anticipated at 218K vs. 215K prior, year there is not any consensus on the

past of writing for Proceeding Claims despite the fact that the prior shed confirmed an

build up to 1794K vs. 1794K anticipated and 1786K prior.

US Jobless Claims

Friday

The Tokyo Core CPI Y/Y is

anticipated at 1.9% vs. 1.6% prior. The ultimate record confirmed a obese reduce within the inflation

price throughout all measures despite the fact that it used to be attributed to a one-off issue as highschool tuition in Tokyo used to be

successfully eradicated and took impact in April. However, inflation in

Japan continues to diversion and it doesn’t justify a price hike from the BoJ

anytime quickly.

Tokyo Core-Core CPI YoY

The Chinese language Production

PMI is anticipated at 50.5 vs. 50.4 prior, year the Services and products PMI is detectable at 51.5

vs. 51.2 prior. We’ve were given some disappointing information not too long ago with commercial

output and retail gross sales lacking expectancies. This implies that the economic system is

nonetheless suffering to get better robustly amid vulnerable home call for, lingering

deflation possibility, and extended condition within the quality sector. If we

proceed to peer condition, the PBoC will most likely react through easing its coverage additional.

China Common PMI

The Eurozone Headline CPI

Y/Y is anticipated at 2.5% vs. 2.4% prior, year the Core CPI Y/Y is detectable at 2.7%

vs. 2.7% prior. This record is more likely to affect the marketplace’s expectancies

for the velocity cuts trail past the June assembly. If truth be told, sizzling inflation information

upcoming robust PMIs, salary expansion and labour marketplace experiences will most likely cause a

hawkish repricing in rates of interest expectancies from the stream 55 bps of

easing detectable through year-end.

Eurozone Core CPI YoY

The United States Headline PCE Y/Y is

anticipated at 2.6% vs. 2.7% prior, year the M/M measure is detectable at 0.26% vs.

0.32% prior. The Core PCE Y/Y is anticipated at 2.75% vs. 2.8% prior, year the

M/M studying is detectable at 0.24% vs. 0.32% prior. Forecasters can reliably estimate

the PCE as soon as the CPI and PPI are out, so the marketplace already is aware of what to

be expecting.

This record is not likely

to modify anything else for the Fed because the central attic left-overs in a “wait and see” method till September at

very least. If truth be told, in spite of yelps of cuts in July or November, I’d say the Fed

will need to bring the primary snip on a gathering containing the SEP (barring a

fast deterioration within the labour marketplace).

US Core PCE YoY