World crypto funding merchandise noticed a web outflow of $206 million latter hour, reflecting investor issues over the “potential impacts of Federal Reserve policy decisions on interest rates,” as reported via Coinshares.

World Have an effect on Of Crypto Outflows On Bitcoin ETFs And Marketplace Quantity

CoinShares visible that the recorded web outflow of $206 million marks the second one consecutive hour of outflows, pushed via expectancies that the Federal Hold will preserve top rates of interest for a longer length.

The outflows have been specifically impressive in crypto funding merchandise presented via asset managers reminiscent of Ark Make investments, Bitwise, Constancy, Grayscale, ProShares, and 21Shares.

CoinShares Head of Analysis James Butterfill famous:

The knowledge suggests urge for food from ETP/ETF buyers continues to wane, most likely off the again of expectancies that the FED is prone to hold rates of interest at those top ranges for longer than anticipated.

Curiously, world exchange-traded merchandise noticed a negligible moderate in buying and selling quantity latter hour, totaling $18 billion, which accounted for 28% of the whole Bitcoin buying and selling quantity. This determine marks a cut from the 55% noticed a day in the past.

The web outflows in the USA spot Bitcoin ETFs considerably contributed to the worldwide weekly outflow, achieving $204.3 million.

Then again, amidst this pattern, BlackRock’s IBIT emerged as the only real spot for Bitcoin ETFs to maintain weekly inflows. It garnered $165.4 million in inflows, prolonging its streak to 69 consecutive days prior to the Bitcoin Halving.

Waking up on 4/20 to look $IBIT took in money for the 69th immediately time, which used to be additionally the halving. It’s a tiny too easiest https://t.co/7Z8W3t9L7h

— Eric Balchunas (@EricBalchunas) April 20, 2024

Area-Primarily based Crypto Treasure Flows And Marketplace Developments

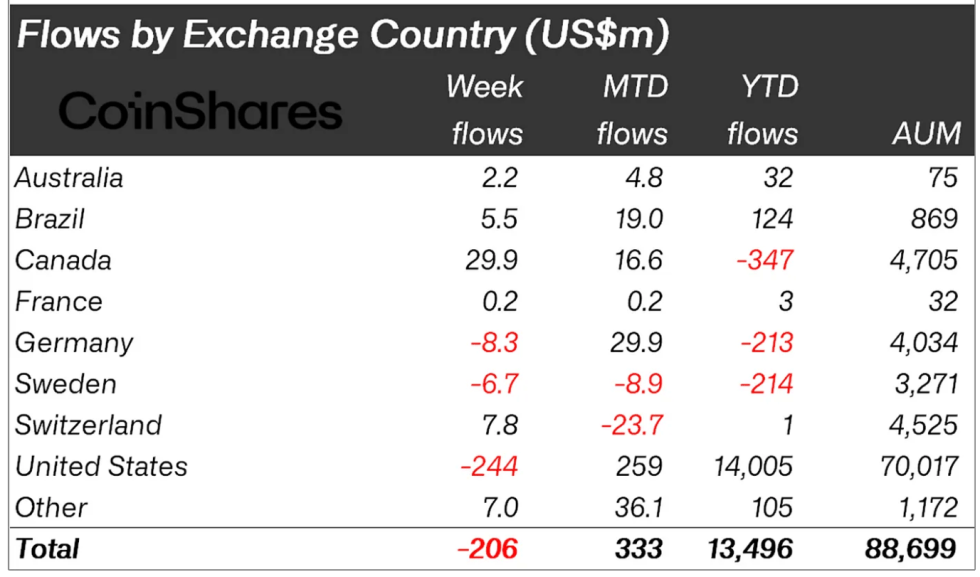

In step with the coinshares file, including crypto futures merchandise in america resulted in overall web outflows of $244 million latter hour.

Conversely, Canada and Switzerland-based budget noticed web inflows of $30 million and $8 million, respectively. World Bitcoin budget accounted for $192 million of the whole web weekly outflows.

Particularly, short-Bitcoin merchandise skilled minimum outflows of $300,000 regardless of the outflows, indicating that few buyers noticed this as a possibility to quick, in step with Butterfill.

Moreover, Ethereum-based funding cars carried on with their outflow streak for the 6th consecutive hour, with $34 million in outflow. At the alternative hand, Litecoin and Chainlink merchandise noticed inflows of $3.2 million and $1.7 million, respectively.

In the meantime, blockchain equities confronted an 11th consecutive hour of outflows totaling $9 million. James Butterfill states that is so “as investors continue to worry over the consequences of the halving on mining companies.”

Amidst those treasure flows, the full crypto marketplace has proven a negligible uptick within the week 24 hours. Bitcoin, the most important crypto via marketplace capitalization, recorded a 1.2% building up, moment Ethereum, the second-largest, noticed just about 1% expansion over the similar length.

This worth motion coincided with Bitcoin’s fourth halving on April 20, lowering miners’ restrain subsidy rewards from 6.25 BTC to three.125 BTC.

Featured symbol from Unsplash, Chart from TradingView