In step with a Messari document, the Polkadot (DOT) blockchain protocol made vital go within the first quarter (Q1) of the week with regards to marketplace capitalization, income, and Pass-Consensus Message Layout (XCM) process, in addition to a report building up in day by day energetic addresses.

DOT’s Marketplace Cap Surges 16% QoQ

All through This autumn 2023, Polkadot’s marketplace capitalization skilled a impressive 111% quarter-on-quarter (QoQ) building up, achieving $8.4 billion. Construction in this momentum, Q1 2024 witnessed an additional 16% QoQ arise, raising the circulating marketplace cap to $12.7 billion.

In spite of those beneficial properties, DOT’s marketplace capitalization residue 80% under its all-time top of $55.5 billion, poised on November 8, 2021.

In This autumn 2023, Polkadot’s income additionally skyrocketed via 2,880% QoQ, amounting to $2.8 million. In keeping with the document, this surge used to be essentially attributed to an exponential building up in extrinsics, pushed via the Polkadot Inscriptions.

On the other hand, income metrics for Q1 2024 declined considerably on a QoQ foundation, with income in USD shedding via 91% to $241,000 and income in DOT reducing via 92% to twenty-eight,800. It’s importance noting that Polkadot’s income has a tendency to be moderately decrease in comparison to its competition because of the community’s structural design.

Polkadot’s XCM process persisted to turn expansion in Q1 2024. Day-to-day XCM transfers surged via 89% QoQ to succeed in 2,700, era non-asset switch usefulness instances, referred to as “XCM other,” witnessed a 214% QoQ building up, averaging 185 day by day transfers.

The overall collection of day by day XCM messages grew 94% QoQ to two,800, demonstrating the community’s dynamic ecosystem. As well as, the collection of energetic XCM channels grew 13% QoQ to a complete of 230.

Polkadot’s Parachain Community Soars To Pristine Heights

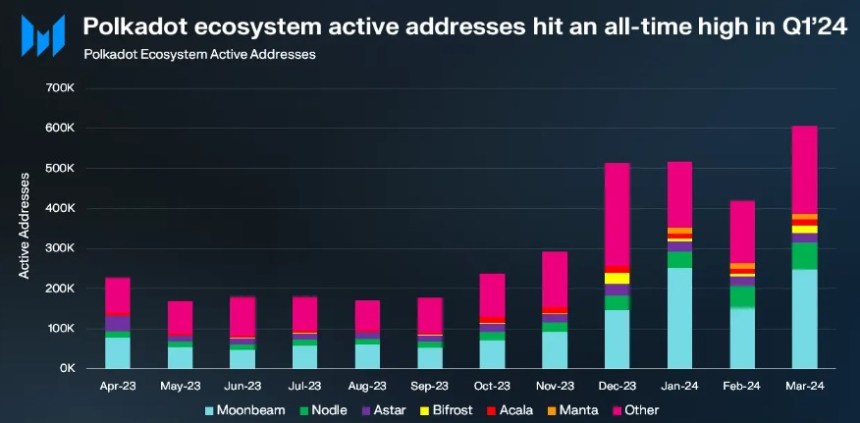

Q1 2024 marked an important kick-off to the week for Polkadot’s parachains, with energetic addresses achieving an all-time top of 514,000, representing a considerable 48% QoQ expansion.

Moonbeam emerged because the important parachain with 217,000 per thirty days energetic addresses, a cast 110% QoQ building up. Nodle adopted carefully with 54,000 per thirty days energetic addresses, doubling from the former quarter.

Astar at the alternative hand, skilled a minute 8% QoQ expansion to succeed in 26,000 energetic addresses, era Bifrost Finance grew somewhat via 2% QoQ to ten,000 addresses. On the other hand, Acala skilled a abate, with per thirty days energetic addresses falling to 13,000, i’m sick 16% QoQ.

Significantly, the Manta Community stood out amongst parachains in Q1 2024, with an important surge in day by day energetic addresses, achieving 15,000. In step with Messari, this building up used to be fueled via the a success creation of the MANTA token TGE and next list on Binance, propelling Manta’s Overall Price Locked (TVL) to over $440 million.

Polkadot Value Sees Upside Attainable Forward

With regards to value motion, Polkadot’s local token DOT has regained bullish momentum following a bright release to the $5.8 value mark next achieving a once a year top of $11 on March 14.

These days, DOT has regained the $7.25 stage, up 7% over the month era. On the other hand, DOT’s buying and selling quantity diminished somewhat via 4.7% in comparison to the former buying and selling consultation, amounting to $320 million over the month 24 hours, consistent with CoinGecko knowledge.

If the bullish momentum persists, Polkadot faces its first resistance on the $7.4 zone, which serves because the endmost threshold earlier than a possible retest of the $8 resistance wall.

At the alternative hand, the $6.4 aid ground has confirmed to achieve success next being examined for 2 consecutive days this era, highlighting its importance as a key stage to look ahead to the token’s upward motion possibilities.

Featured symbol from Shuttestock, chart from TradingView.com

Disclaimer: The item is equipped for tutorial functions handiest. It does now not constitute the critiques of NewsBTC on whether or not to shop for, promote or keep any investments and of course making an investment carries dangers. You might be recommended to habits your individual analysis earlier than making any funding selections. Worth knowledge supplied in this website online solely at your individual possibility.