Este artículo también está disponible en español.

Crypto investors are not keen on dealing with cryptocurrency trading platforms, which has resulted in the dwindling exchange reserves of Bitcoin and Ethereum. Centralized exchanges on Bitcoin and Ethereum hit a historic low after investors and crypto enthusiasts opted for self-custody solutions for their virtual assets.

Related Reading

Staying Away From Cryptocurrency Trading

A recent trend showed that traders and other enthusiasts choose to hold on to their crypto assets rather than sell them on Bitcoin and Ethereum exchange platforms.

They preferred direct ownership of their assets using self-custody wallets, which created an increasing demand for self-custody solutions. However, it led to a decline in the liquidity of BTC and ETH on centralized exchanges.

Strengthening Bitcoin And Ethereum Values

A positive consequence of traders’ preference for self-custody solutions is the increasing value of Bitcoin and Ethereum assets over time. Traders veering away from cryptocurrency trading platforms create a sense of scarcity, leading to the growth of its value.

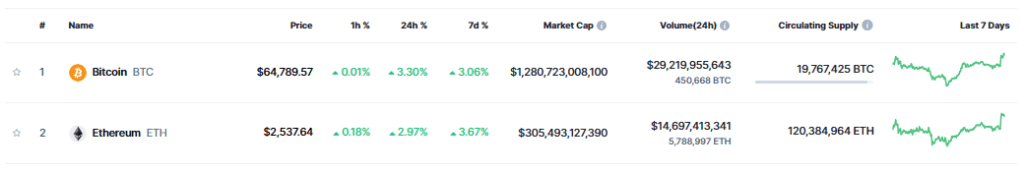

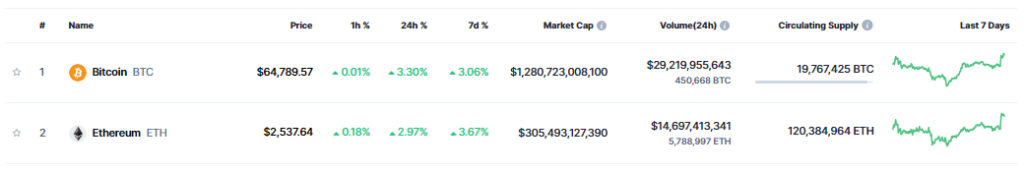

At the time of writing, the price of Bitcoin is pegged at $64,842. Since hitting a record-high of $73,000 in March this year, the price remains somewhere between $66,000 and $49,000. Meanwhile, according to Coinmarketcap, Ethereum is trading at $2,464.

Bitcoin, Ethereum Reserves Drop

Bitcoin and Ethereum on centralized reserves took a nosedive and hit a historic low early this month. As of October 13, CryptoQuant’s chart showed that centralized exchanges for BTC recorded an all-time low of 2,666,717 bitcoins.

The highest amount of Bitcoin was pegged at 3,361,854, which was recorded on June 8, 2022. After that period, Bitcoin went on a sharp decline. It hit its lowest level early this month.

In terms of volume, spot exchanges have 1.1 million Bitcoin in reserves, while derivative exchanges own 1.39 million reserves. By far, Binance owns 563,000 Bitcoin reserves, the largest crypto exchange by trading volume, followed by Kraken with 112,3000 reserves.

On the other hand, Coinbase Advanced holds 830,530 Bitcoin reserves and Coinbase Prime has 3,000 reserves. Ethereum’s centralized exchanges also face a similar dilemma to Bitcoin wherein its reserves continue to plummet and hit a record low of 18.7 million.

Related Reading

According to CryptoQuant, derivative exchanges hold a big portion of Ethereum with 10.3 million in reserves, while 8.4 million Ethereum reserves are being kept at spot exchanges.

Historically, Ethereum’s all-time high in reserves was 2,310,823 recorded on 6 September 2022. Since that period, Ethereum reserves in central exchanges continue to plunge.

In terms of reserves, Coinbase has a large reserve of 4.5 million Ethereum, followed by Binance with 3.6 million Ethereum. Kraken also holds a significant Ethereum reserve of 1.3 million.

Featured image from Pexels, chart from TradingView