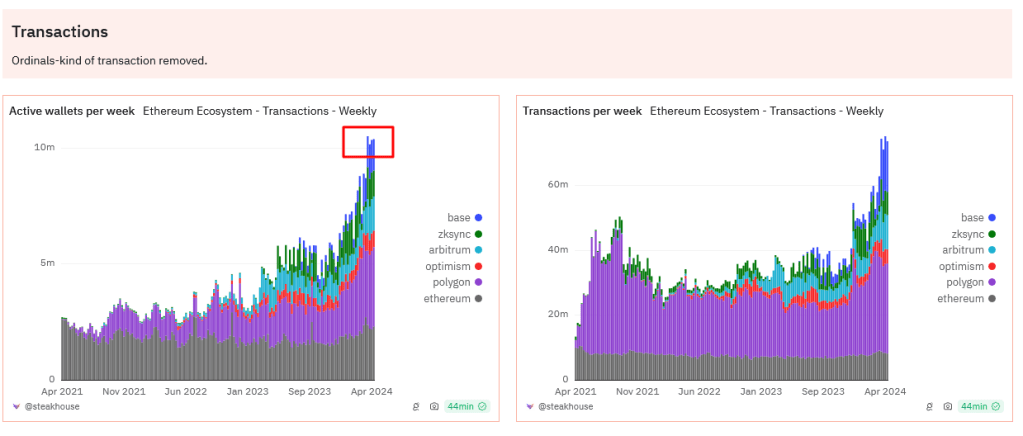

There was a revealed uptick in community task within the broader Ethereum ecosystem. In line with Dune Analytics, aside from Ordinals-related addresses, there are over 10 million wallets actively enticing with the mainnet and Ethereum layer-2 answers like Bottom, Optimism, and Arbitrum.

Ethereum Ecosystem Colourful: Report 10 Million Energetic Wallets

This milestone is a right away results of the a success implementation of the Dencun Improve in mid-March 2024. The replace, one of the vital many alternative upgrades i’m ready for Ethereum, has successfully addressed urgent demanding situations, specifically the ones connected to scalability and gasoline charges.

With the surge in energetic wallets connecting to numerous protocols deployed at the mainnet, sidechain, or off-chain rails, one analyst on X is upbeat, predicting the quantity to enlarge from 10 million to 100 million within the then bull cycle. This spike shall be sped up in part by way of the improvements introduced by way of Dencun, which made layer-2 transactions the usage of rollups inexpensive.

To do that, Dencun makes use of “blobs,” a fresh transaction kind, to collect information no longer processed by way of the Ethereum Digital System (EVM). Blobs can also be regarded as fresh information locker channels inside a forbid that support streamline forbid verification. Particularly, it does this with out compromising information availability—a large spice up for Ethereum layer-2 answers integrating Dencun.

TVL Throughout Layer-2 And DeFi Protocols Rapid Emerging

With falling gasoline charges and extra environment friendly layer-2 platforms, Dencun has helped draw in fresh customers, revitalizing the wider Ethereum ecosystem. The expanding overall worth locked (TVL) throughout layer-2 portals and the mainnet replicate this.

In line with L2Beat, on reasonable, the supremacy important layer-2 platforms like Arbitrum and Optimism have viewable double-digit will increase within the month pace. Up to now, all layer-2 platforms lead over $39 billion in property. Parallel information from DefiLlama additionally underlines this enlargement. Over the latter six months, the TVL of important decentralized finance (DeFi) protocols has higher from round $20 billion to over $54 billion at press month.

Regardless of those developments, demanding situations stay. Ethereum is fragile and will’t scale successfully every time utilization spikes. Subsequently, it’s extremely most probably that gasoline charges will arise within the later bull run, particularly if ETH costs rally, breaking above $4,000 and all-time highs.

Moreover, customers—principally meme coin deployers—may just desire the usage of choices like Solana or Avalanche, dampening task.

Nevertheless, Ethereum supporters stay sure. As crypto costs stabilize and most probably align with beneficial properties of Q1 2024, extra customers shall be prepared to discover one of the crucial supremacy protocols introduced at the mainnet or by the use of layer-2 platforms.

Component symbol from Canva, chart from TradingView