Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Warren Buffett has sought to reassure Berkshire Hathaway shareholders that he would always prefer owning businesses, after his move to dump stocks and the lack of a big acquisition helped drive the group’s cash pile to a record high last year.

In his annual letter to shareholders, released on Saturday, the billionaire investor said he would “never prefer ownership of cash-equivalent assets over the ownership of good businesses”, a category that also includes the stakes Berkshire owns in US blue-chip companies.

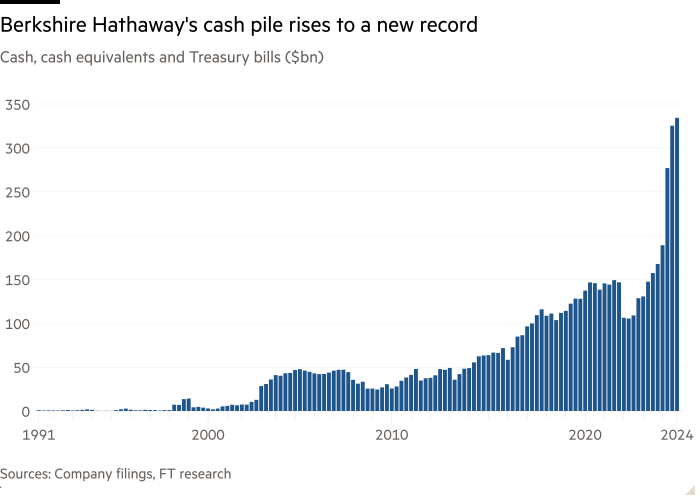

The 94-year-old’s decision to address the cash pile, which hit $334.2bn at the end of last year, comes as record valuations have dented the appeal of US stocks and also made it harder for Buffett to unearth the major deals that have long been his trademark.

In his letter, Buffett said: “Berkshire shareholders can rest assured that we will forever deploy a substantial majority of their money in equities — mostly American equities although many of these will have international operations of significance.”

The letter was released alongside Berkshire’s fourth-quarter results, which showed its cash pile grew by $9bn in the quarter, as Buffett trimmed stakes in stocks, including multibillion-dollar sales of shares in Citigroup and Bank of America.

The group’s cash pile has almost doubled over the past year as it ploughed the proceeds of stock sales — including tens of billions of dollars’ worth of shares in Apple — into Treasury bills.

Berkshire, a sprawling conglomerate with businesses ranging from US insurer Geico to railroad BNSF, disposed of $143bn of stocks in 2024, far surpassing the $9bn it invested in equities.

Berkshire’s increasing shift into US government debt has been a boon for the company since the Federal Reserve began lifting interest rates in 2022.

Last year, the company’s insurance subsidiary reported $11.6bn of interest income, mainly from its holdings of Treasury bills, comfortably exceeding the dividends it receives from its portfolio of stocks.

“We were aided by a predictable large gain in investment income as Treasury Bill yields improved and we substantially increased our holdings of these highly liquid short-term securities,” Buffett told shareholders.

The conglomerate reported operating earnings of $47.4bn for 2024, up 27 per cent from 2023, led by a stronger performance by its insurance business.

The operating results exclude changes in the value of Berkshire’s $272bn stock portfolio, swings which Buffett has long dismissed as largely meaningless. Berkshire disclosed that it made $101bn of gains on stock sales last year.

Addressing the group’s cash pile, Buffett pointed to the rise in value of Berkshire’s nearly 200 operating subsidiaries, which include the ice cream chain Dairy Queen and underwear maker Fruit of the Loom, as one indication that the “great majority” of Berkshire’s investments remained in a mix of businesses and equities.

The billionaire also warned shareholders of the danger to the value of a country’s debt and currency should “fiscal folly” prevail.

The warning comes as bond investors weigh up Donald Trump’s pledge to slash federal spending against the inflationary threat from the tariffs the US president has promised to impose on America’s trading partners.

“Paper money can see its value evaporate if fiscal folly prevails,” he wrote. “In some countries, this reckless practice has become habitual, and, in our country’s short history, the US has come close to the edge. Fixed-coupon bonds provide no protection against runaway currency.”

While Berkshire has sold more stocks than it has bought for nine consecutive quarters, Buffett said he expected the group to boost its stakes in five Japanese trading groups that it first backed in 2019.

He added that the five businesses — Mitsubishi Corp, Mitsui & Co, Itochu Corp, Sumitomo Corp and Marubeni Corp — had agreed to let Berkshire’s stakes exceed a 10 per cent threshold previously agreed.

“Over time, you will likely see Berkshire’s ownership of all five increase somewhat,” Buffett said, adding that the future leaders of Berkshire “will be holding this Japanese position for many decades”.

Buffett said the stakes, which Berkshire paid $13.8bn for, are now worth $23.5bn.

Berkshire also confirmed that the company has not bought back its own shares since May, an indication Buffett does not see the stock as cheap. The company’s class A stock has returned 109 per cent over the past five years.

“Often, nothing looks compelling; very infrequently we find ourselves knee-deep in opportunities,” he said.