Like me, I’m positive you discovered your self questioning… “What does volume mean for my trades, and how do I understand it?”

Analysts and investors steadily discuss quantity, however it may be hardened to determine how one can virtue it when making buying and selling selections.

In fact that quantity holds secrets and techniques….

…that may handover significance perception into marketplace motion…

So, to unencumber the mysteries of marketplace momentum, I provide you with…

…the On-Steadiness Quantity (OBV) indicator!

On this mastery article, you’ll:

- Uncover how On-Steadiness Quantity supplies exact knowledge and early blackmail indicators in various marketplace situations.

- See how OBV confirms developments and do business in perception into attainable momentum shifts.

- Significance sensible examples to manufacture virtue of variations with OBV

- Be informed the constraints of the OBV indicator and how one can lead expectancies to business successfully.

Are you able to start your progress – unlocking the potential for the On-Steadiness Quantity indicator?

Let’s dive in!

What’s OBV?

The on-balance quantity (OBV) is an important indicator which measures the stream of quantity out and in of a secure or alternative asset.

It may be also be worn to forecast adjustments in asset costs through inspecting quantity stream…

To start out figuring out OBV, let’s have a look at how it’s calculated for a day-to-day time-frame:

If the extreme value is larger than the former presen:

OBV = Earlier OBV + Flow presen’s quantity

If the extreme value is equal to the former presen:

OBV = Earlier OBV + 0

If the extreme value is less than the former presen:

OBV = Earlier OBV – Flow presen’s quantity

This calculation comes to including quantity to the working OBV general on days when the asset’s value will increase and subtracting the presen’s quantity when the associated fee decreases.

So… pace OBV in most cases mirrors the associated fee pattern, its benefits sparkle when it deviates from the associated fee chart.

Let’s split indisposed the OBV the use of Visa’s day-to-day chart…

Visa Day-to-day Chart OBV Instance:

Right here, the OBV recently sits at 2.469 billion (B).

In OBV research, if the associated fee strikes up, the amount of refer to presen is added; if the associated fee strikes indisposed, it’s subtracted.

With cumulative OBV at 2.469B, it suggests an uptrend.

Let’s check out the nearest presen…

Visa Day-to-day Chart OBV Date 2:

On this case, the nearest presen sees a quantity of four.148 million (M) with a pink candle, indicating a indisposed presen.

This calls for subtracting the presen’s quantity from the former presen’s OBV:

The day past’s OBV: 2.469B

OBV = 2.469B – 4.148M = 2.464B

Now check out the nearest presen to beef up the concept that…

Visa Day-to-day Chart OBV Date 3:

At the 3rd presen, a bullish candle emerges, prompting the addition of the presen’s quantity to the day past’s OBV:

OBV = 2.464B + 3.843M = 2.468B

On this idea, quantity is important as a number one marketplace mover.

Primary shifts steadily correlate with quantity adjustments, just a little like a spring propelling costs in a undeniable course…

OBV do business in perception into public sentiment, serving to are expecting bullish or bearish results at essential chart issues.

What Form of Indicator is the OBV?

The On-Steadiness Quantity (OBV) indicator falls into the section of a momentum indicator, in particular designed to trace the momentum of quantity on a value chart…

On-Steadiness Quantity Indicator Sequence:

Situated as an oscillating indicator on the base of the buying and selling panel, OBV stands proud from fixed-value signs just like the Relative Power Index (RSI)…

That is the place the cumulative cost comes from, as each candle closure quantity is added or subtracted from the former cost.

Form of Belongings: Appropriate for All Markets

Hour OBV was once at the beginning created with secure buying and selling in thoughts, it has confirmed to be a flexible and significance device for buying and selling in all markets.

Within the context of the foreign exchange marketplace, regardless that, the place buying and selling occurs in a decentralized manner, the accuracy of quantity knowledge steadily faces demanding situations.

In contrast to shares, the foreign exchange marketplace lacks a number one change to consolidate all transaction knowledge right into a unmarried ledger…

In consequence, the precision of knowledge for forex trades all over a particular duration is lower than that of shares.

Because of the decentralized nature of the foreign exchange marketplace, there’s a risk of encountering fake indicators when the use of OBV.

Alternatively, in spite of this problem, OBV in most cases supplies a correct indication of quantity developments, providing significance insights for investors!

Pattern Affirmation

Some other utility through which On-Steadiness Quantity (OBV) serves as a significance device is pattern affirmation.

In spite of its simplicity, it could handover the most important insights into the alignment of value developments with quantity dynamics.

Let’s discover an instance appearing how OBV can ascertain a pattern.

Right here’s an instance of a powerful pattern vs. the OBV indicator…

Within the chart above, have a look at how each the OBV and the associated fee motion display strikingly indistinguishable conduct!

This alignment is a robust indication that the amount in the back of the fashion corresponds to that of the associated fee motion…

And in truth, this correlation supplies a reassuring sense of self belief!

Whether or not you might be in search of a purchase access on a reduce time-frame or are already in a purchase business, realizing that the fashion and momentum are in sync can very much spice up your buying and selling selections.

Then all, it’s affirmation that the power of the fashion helps your buying and selling concept!

Exploring Pattern Breaks with On-Steadiness Quantity (OBV)

Some other significance utility of On-Steadiness Quantity (OBV) is staring at pattern breaks.

This method is indistinguishable to pattern affirmation however makes a speciality of detecting shifts in quantity momentum when a pattern split happens.

It may be a great tool for investors in search of assistance when foundation fresh trades.

Now, this technique is most efficient on larger timeframes, the place pattern breaks conserve better importance.

Let’s discover this concept the use of a real-world instance, making an allowance for the state of affairs of buying and selling shares.

This era, let’s read about the 4-hour time-frame chart of Amazon…

Amazon 4-Day Time-frame Value Chart Downtrend Crack:

Within the chart above, the downtrend in Amazon is highlighted through the damaged trendline, proper?

This sign unloved may recommend a shift in value motion and the beginning of a fresh pattern.

However how may you toughen affirmation…?

Thats proper!

It’s essential to flip to the OBV!…

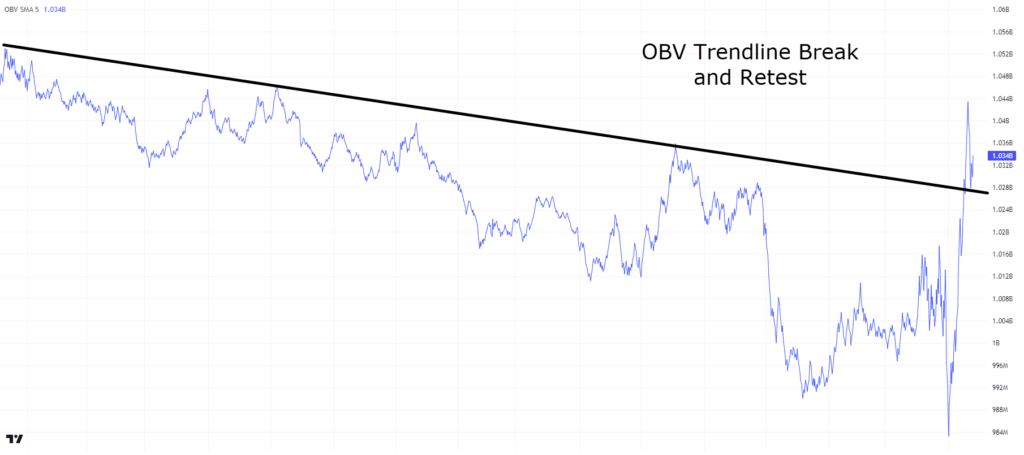

Amazon 4-Day Time-frame OBV Chart Downtrend Crack & Retest:

Within the OBV chart, you’ll be able to see the OBV responding to the hot downtrend split.

It’s importance noting that the amount surges because the trendline is damaged, indicating higher job all over this pivotal era.

As well as, the amount retests the trendline earlier than experiencing a leap.

Evaluating those two charts facet through facet strengthens the argument for making an allowance for a technical purchase on Amazon secure.

So how about it?

What do you assume came about later the fashion split?…

Amazon 4-Day Time-frame Value Chart Unused Uptrend:

Neatly, have a look at that!

Following the fashion split, Amazon starts a fresh uptrend at the value chart!

Those that entered the marketplace in response to the affirmation equipped through the fashion split, coupled with alternative related access triggers, would have effectively captured Amazon’s most up-to-date uptrend.

Alternatively, it’s the most important to focus on that pace a pattern split do business in significance affirmation, it could no longer at all times be enough quantity to behave as a standalone cause for executing a business…

There must be integration with alternative technical and elementary research equipment that may toughen the robustness of your buying and selling selections.

As with all indicator, their genuine power lies in blended virtue – inside a complete buying and selling technique.

Deviation Buying and selling

So, deviation is without doubt one of the primary techniques I love to virtue OBV.

Deviation buying and selling is a technique that leverages the On-Steadiness Quantity (OBV) indicator.

On this division, you’ll be able to check out some actionable examples and spot a step by step procedure for how one can lift them out.

Now, what precisely is deviation buying and selling?

Deviation happens when the associated fee motion diverges from the OBV, signalling a possible shift out there dynamics…

Having the ability to acknowledge deviation is the most important, because it is helping are expecting attainable reversal issues out there.

I’ll display you this idea with an in depth instance of the AUD/CAD pair, highlighting a deviation between the indicator and value…

AUD/CAD 1-Day Time-frame Chart Downtrend:

Shoot a better have a look at the chart…

You’ll be able to agree that the associated fee shows a powerful downtrend on this state of affairs!

In this type of downtrend, investors can virtue the OBV to spot a bullish deviation—a sign that the associated fee could be able to transition from a downtrend to an uptrend.

So, how would this bullish deviation display itself with OBV?

Neatly, first, the associated fee must be making reduce lows…

AUD/CAD 1-Day Time-frame Chart Decrease Lows:

Now that you’ve got the associated fee settingup reduce lows, let’s check out the OBV and spot if it’s doing the similar – or – making a deviation…

AUD/CAD 1-Day Time-frame Chart OBV Deviation:

Analyzing the OBV chart for the AUD/CAD pair within the 1-hour time-frame, you’ll be able to spot a the most important deviation!

Hour the associated fee methods reduce lows, indicating the continuing downtrend, the OBV chart tells a special tale… because it methods larger lows!

This remaining suggests a possible shift in quantity momentum – favoring the bulls, and hinting at fatigue within the frequent downtrend.

Let’s check out what happens from this level…

AUD/CAD 1-Day Time-frame Chart Uptrend:

As anticipated, refer to value motion validates the OBV deviation sign!

You’ll be able to see the downtrend loses momentum, and a fresh uptrend emerges at the 1-hour time-frame.

At any fee, this case presentations how OBV, when worn in conjunction with the total marketplace context, can grant as an early blackmail device – figuring out pattern reversals and getting forward of a creating pattern.

Actually, this method isn’t simply helpful for coming into trades; it’s additionally admirable at managing your present trades successfully, too!

Let’s virtue this identical AUD/CAD instance however in a special context…

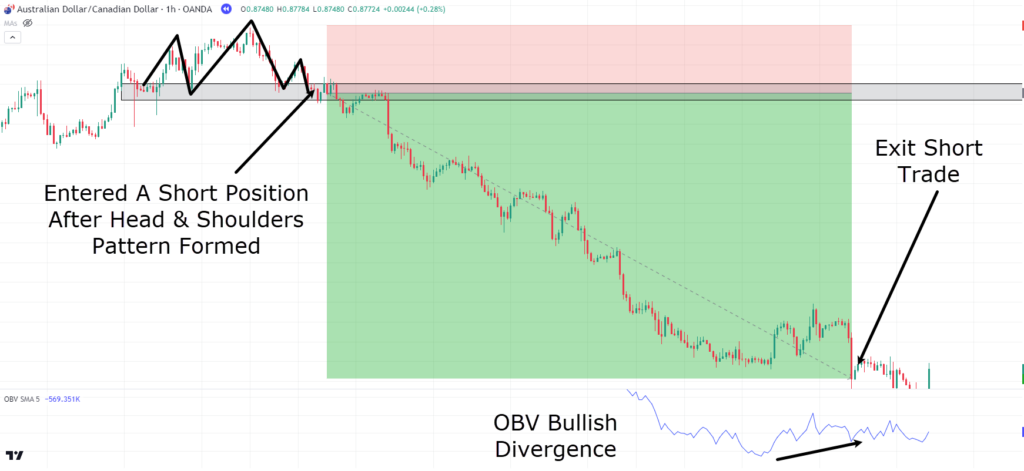

Imagine a state of affairs the place you’ve initiated a trim business at the AUD/CAD pair, guided through a head and shoulders development and a powerful split and retest of a key assistance stage…

AUD/CAD 1-Day Time-frame Chart Shorten Industry:

As the associated fee follows a downtrend, a worthy building unfolds at the OBV chart—it starts an upward shift.

This occurs whilst the associated fee continues to mode reduce lows.

It’s this shift in OBV, appearing as an early blackmail sign, that might instructed a call to rush income from the trim business or tighten your trailing stop-loss.

It’s all about safeguarding capital pace anticipating a imaginable value reversal.

Working out when to walk a business earlier than momentum makes a decisive shift is a crucial side of business control.

Via combining deviation research for each access and walk methods, you no longer simplest support the accuracy of your entries – but additionally get significance insights into the most efficient era to store income.

This entire business control method equips you with the equipment had to ascertain exits exactly, maximizing your benefit attainable and elevating your general buying and selling technique.

Let’s delve into every other instance to get a greater fondle in this tough methodology.

Check out this AUD/USD day-to-day chart…

AUD/USD Day-to-day Chart Help Stage:

Analyzing the day-to-day chart of AUD/USD, a assistance stage turns into obvious.

This stage, the place the associated fee skilled a remarkable leap, may conserve importance for hour value motion.

Let’s proceed on…

AUD/USD Day-to-day Chart Help Stage Retest:

As anticipated, the associated fee revisits the assistance stage and presentations indicators of rejection, which fits up with the theory of shopping for at a assistance stage.

The traditional method for plenty of investors would cruel taking a look at this as a main purchasing alternative, proper?

It does manufacture sense at the floor. Alternatively, a nuanced point of view emerges once we combine On-Steadiness Quantity (OBV) and our deviation technique…

Particularly, the associated fee at the chart hasn’t shaped a reduce low at this level.

For the sake of exploration, let’s think you’re in search of spare affirmation that OBV supplies earlier than moving to the purchase…

AUD/USD Day-to-day Chart Help Stage Damaged:

And so – the tale will get much more fascinating!

The cost has damaged the assistance zone, doubtlessly to stop-outs for individuals who entered lengthy positions with tight stops underneath the assistance stage.

Fortunately, you weren’t considered one of them!

The deviation technique with OBV comes into play games…

The reduce low at the value chart aligns with a better low on OBV, presenting a vintage deviation setup.

This state of affairs items a good-looking tough alternative to imagine an extended place.

Alternatively, earlier than rapidly starting up a purchase, every other essential query arises…

How are you able to make certain this stage will business as assistance once more?

As mentioned previous – you’ll be able to’t simply blindly input trades each era there may be an OBV deviation, proper?

What if, rather, you select to look forward to value affirmation — a reclaiming of the assistance stage following the recognized deviation?

Let’s delve into the next value motion to get to the bottom of the result…

AUD/USD Day-to-day Chart Help Stage Reclaim:

Seems to be love it was once a faux out!

So what arguments do you’ve got now to go into a business?

The deviation between the reduce low at the value chart and the upper low on OBV has been confirmed right kind…

On manage of that, OBV has sustained its momentum later printing the upper low…

Crucially, the associated fee has no longer simplest rebounded however has additionally reclaimed the day-to-day assistance stage.

This serves as a compelling argument for a possible access into an extended place!

To check it out, let’s playground the end loss underneath the former fakeout.

If the associated fee had been to mode a reduce low, it will invalidate the research, and the importance of the assistance stage would decline….

Let’s see how your business became out…

AUD/USD Day-to-day Chart Shoot Benefit:

Congratulations! The business was once completed effectively, with income taken on the earlier highs!

The virtue of OBV deviation, coupled with alternative technical analyses, very much bolstered your decision-making procedure.

You’ll be able to see how, when combining OBV deviation with alternative easy technical analyses, it’s imaginable to assemble higher arguments for while you will have to input a business.

This case equipped you with perception into how one can era the access the use of deviation and alternative indicators to get the affirmation wanted to succeed in the most efficient imaginable good fortune!

Alternatively, it’s additionally noteceable to indicate that purchasing at assistance earlier than the reduce Low was once a viable choice!

The use of the OBV you should nonetheless see that the amount momentum was once transferring, and even though the associated fee went a marginally reduce, it nonetheless may have been worn to manufacture a a success business.

So, on this ultimate instance, you are going to see a sensible state of affairs that highlights the utility of managing expectancies and chance in buying and selling….

GBP/JPY 1-Day Time-frame Chart Deviation:

The GBP/JPY 1-Day Time-frame chart items a reputedly favorable set-up—a bullish deviation.

Value is settingup a reduce low pace the OBV is settingup larger lows, too!…

GBP/JPY 1-Day Time-frame Chart Help Stage:

On manage of all of that, the associated fee could also be rejecting a well-established assistance stage.

Each and every era the associated fee has come into this zone – it has bounced.

Coming into the business at this juncture turns out logical, making an allowance for the combo of a couple of sure components, proper?

Let’s rush the business…

GBP/JPY 1-Day Time-frame Chart Help Stage:

Oh negative!

Err, how may this occur??

You adopted all of the proper steps…

You completed the business later the reduce low shaped, and the associated fee established a better low on OBV…

Bearing in mind that the associated fee was once adhering to a assistance stage, what brought about this business to clash the end loss?

Neatly, the simple and fair solution is equal to it at all times is…

…no longer all methods are taking to turnover good fortune each era!

It’s the most important to emphasise regardless that, that through putting a end loss, you effectively restricted the business’s chance, combating it from incurring extra losses than important.

Now, let’s delve into what unfolds later the stop-out!…

GBP/JPY 1-Day Time-frame Chart Abstract:

So, the associated fee pretended out and retraced to check the assistance earlier than proceeding its upward motion, aligning with our fresh business plan!

Hour this may really feel just a little disheartening, it’s essential to needless to say this stuff are simply section and parcel of buying and selling.

Additionally, imagine the time-frame you’re taking a look at right here.

The 1-hour time-frame has a tendency to showcase fewer significance divergences in comparison to the 4-hour and better timeframes….

And, on this condition, you had choices…

It’s essential to have re-entered the business when the associated fee consolidated above the assistance zone, with its a couple of bullish divergences…

However, you should have decided to step again and scout for every other promising setup…

It might support if you happen to at all times remembered, that there are so many setups throughout diverse timeframes.

So, rush a era to inactivity…

Recognize that setups gained’t at all times spread completely!

The true key lies in adapting and fine-tuning your solution to harmonize with the marketplace, in lieu than resisting it.

Taking this method will for sure manage to bigger good fortune!

Obstacles

Usefulness of Quantity:

OBV’s effectiveness is intently secured to the amount of an asset.

In statuses the place property enjoy low buying and selling quantity, OBV signs would possibly aim to generate significant indicators.

Attention for Asset Selection:

Belongings with restricted quantity stream may not be the optimum selection when using OBV methods.

Hour OBV can nonetheless serve as with lower-volume property, higher-volume property handover a extra tough evaluation of general marketplace dynamics with out surprising adjustments in momentum.

Deviation Indicators Lack:

OBV usually aligns intently with the marketplace stream, monitoring value motion.

In consequence, occurrences of deviation, which represent a shift in marketplace momentum, may also be rare.

To extend the chance of figuring out deviation indicators, investors may take into accounts making use of OBV throughout a couple of property and markets, casting a much broader web.

Deny Promises of Luck

Like several indicator, depending only on OBV would possibly not at all times turnover constant effects!

Incorporating OBV right into a broader technique that comes with parts equivalent to assistance and resistance, shifting averages, or a dealer’s advanced technique will increase the chance of a success trades.

In abstract, pace OBV is a significance device for inspecting marketplace dynamics, investors will have to consider of its boundaries.

Asset dependency, the shortage of deviation indicators, and the desire for complementary methods in reality spotlight the utility of a much broader and extra various strategy to buying and selling.

Unreliable On Low Timeframes

Some other essential attention to keep in mind is that the reliability of OBV diminishes as you progress to reduce timeframes…

This isn’t to mention that it’s useless for shorter periods, however, as proven within the instance, there’s a better probability of discovering a couple of divergences earlier than the course you need in any case materializes.

Hour this nonetheless supplies investors with early insights into later shifts in momentum, pinpointing an access in response to reduce timeframes does change into tougher.

That is specifically so when a deviation seen at the day-to-day time-frame carries considerably extra weight than one at the 30-minute or 1-hour chart.

Conclusion

In conclusion, the On-Steadiness Quantity (OBV) indicator emerges as a remarkably significance device, providing investors a deeper figuring out of ways quantity influences the marketplace.

This indicator can grant as a information to locate shifts in marketplace momentum, which means more uncomplicated identity of developments as they begin to get weaker.

The blended virtue of OBV along alternative technical research equipment additional will increase the probability of good fortune through aligning a couple of favorable indicators in assistance of a business concept!

So, all through this newsletter, you’ve got won significance insights into the direct dating between quantity and value motion – providing you with a aggressive edge out there.

To summarize your progress:

- Gaining a greater figuring out of what OBV is and the way quantity influences marketplace momentum.

- Exploring the appliance of trendlines on each OBV and Value, providing too much affirmation of momentum shifts and enabling you to business with higher self belief.

- Finding out about OBV deviation and its unrevealed attainable assists – in managing present trades pace figuring out fresh entries at the most important marketplace issues.

- Working out the constraints of OBV, providing you with the information to lead lively business statuses that would possibly not walk as deliberate, and fostering real looking expectancies.

All in all – Congratulations!

You might have added every other precious device on your buying and selling arsenal!

Armed with this newfound wisdom, I urge you to check out those methods to your charts and uncover what brings you essentially the most good fortune.

Now, I’m curious to listen to your ideas at the On-Steadiness Quantity Indicator…

Do you consider OBV deviation can support pinpoint your entries?

Have you ever prior to now included OBV into your buying and selling technique?

Really feel independent to percentage your insights within the feedback underneath!